“How many business credit cards should I have?” is one of 2025’s hottest questions for entrepreneurs and business owners aiming to harness the power of credit strategically. Having the right number of business credit cards can accelerate cash flow, improve credit scores, simplify expense tracking, and maximize rewards without risking your business’s financial health. This guide shares 3 powerful reasons to help determine your ideal business credit card count and how to leverage them for maximum advantage.

Table of Contents

How Many Business Credit Cards Should I Have?

Why Business Credit Cards Matter

Business credit cards differ from personal credit cards by offering tools tailored for companies, including higher spending limits, categorization of expenses, and reward programs built for business needs. Choosing the right number of cards is crucial to maintain financial health and realize growth opportunities efficiently.

An organized desk showing several business credit cards fanned out in someone’s hand, with financial documents and a laptop in the background.

Reason 1: Optimizing Credit Utilization and Score

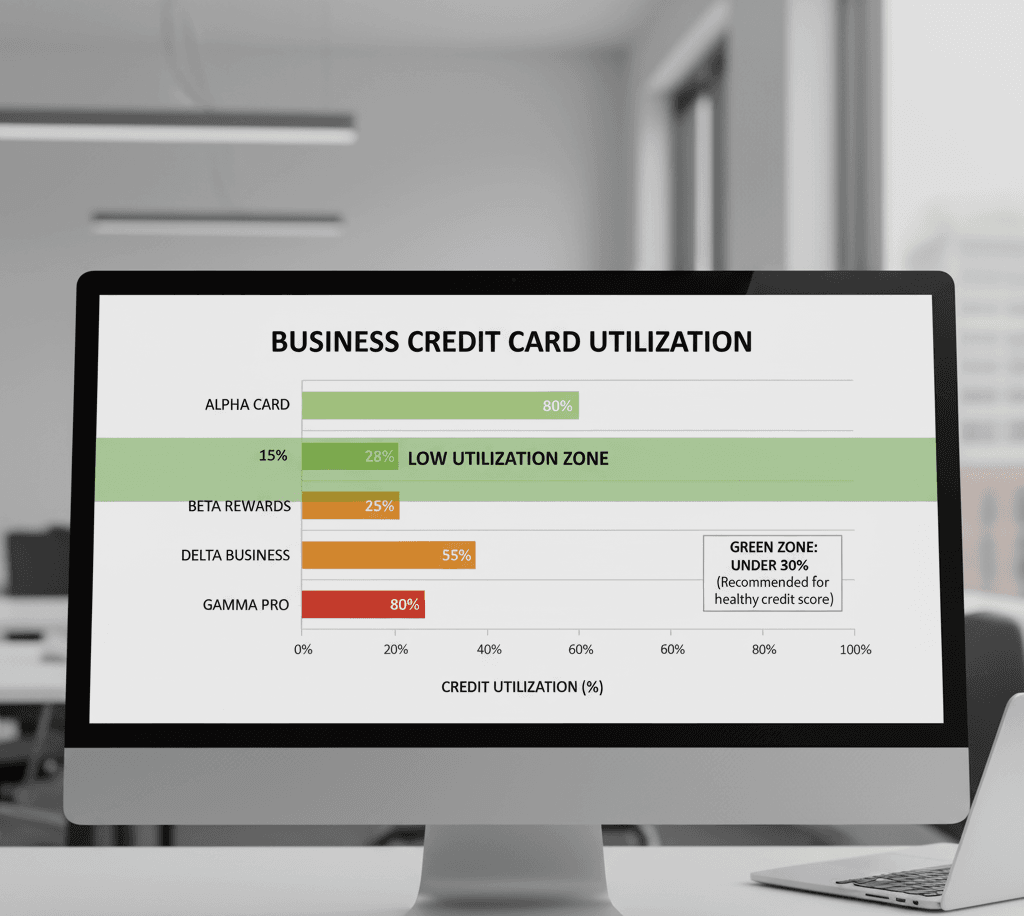

Credit utilization—the ratio of your credit card balances to credit limits—is a leading factor in business credit scoring. Properly spreading expenses across multiple cards can keep individual utilization low, positively impacting your business credit score.

- Multiple cards reduce risk by avoiding overuse of one limit.

- Improves ability to handle varying monthly expenses without maxing out.

- Helps secure better financing options by showcasing smart credit management.

Experts recommend keeping credit utilization below 30% on each card to maximize score benefits.[2][3]

Graph showing credit utilization percentages across 3-4 business credit cards with a green zone under 30%.

Reason 2: Maximizing Rewards and Benefits

Different business credit cards offer varied rewards focusing on travel, office supplies, marketing expenses, or cash back. Owning multiple cards lets you strategically allocate spending to extract the highest possible rewards.

- Use travel-focused cards for flights and hotels.

- Employ cashback cards for everyday business expenses.

- Specialized cards may offer discounts on software, advertising, or equipment.

This tailored approach multiplies savings and perks, contributing directly to your business’s bottom line.

Collage of business credit cards featuring diverse reward categories like travel, cash back, marketing, and software subscriptions.

Reason 3: Simplifying Business Spending Management

Having multiple credit cards allows better segregation of expenses across departments, projects, or spending categories. This organization aids in budgeting, accounting, and tax reporting.

- Assign cards to specific teams or expense types.

- Simplify reconciliation with detailed statements.

- Minimize errors and improve forecasting.

The clarity gained from this segmentation is invaluable for growing businesses.

How Many Business Credit Cards Should You Have?

There is no one-size-fits-all answer. Most small to mid-sized businesses find 2-4 cards ideal, balancing credit utilization, rewards, and management ease. Startups might begin with one or two cards and expand as expenses and opportunities grow.

- Beginners: 1-2 cards focused on core spending areas.

- Growing businesses: 3-4 cards for targeted rewards and spending control.

- Established companies: 4+ cards to maximize benefits, with strict management.

Avoid juggling too many cards at once, which can complicate tracking and incur unnecessary fees.

External Link: How Many Business Credit Cards Should I Have? – NerdWallet[2]

prompt: Business owner comparing options with a pile of 3-4 business credit cards and spreadsheets.

Top Tips for Managing Multiple Business Credit Cards

- Automate payments to avoid late fees.

- Use accounting software integrations like QuickBooks or Xero.

- Monitor credit limits and utilization regularly.

- Review card fees versus rewards to optimize profitability.

- Keep personal and business cards fully separate.

Smart management lets you harness multiple cards’ power without risk.

External Link: Top Travel Agent Tools for 2025 (also great for finance management)[4]

Conclusion: Your Smart Strategy for Business Credit

“How many business credit cards should I have” is a strategic question with 3 powerful considerations—credit score optimization, reward maximization, and spending management. By tailoring your number of cards to your business size and spending habits, you unlock financial flexibility and savings crucial for growth in 2025. Start smart, stay organized, and watch your business credit work for you.

External Link: Best Business Credit Cards in India 2025 – Paisabazaar[5]

External Link: How Many Business Credit Cards Should I Have? – NerdWallet[2]

Internal Link: https://mysportinfo.com/incredible-college-football-coaches-poll-rankings/

- https://ramp.com/blog/how-many-business-credit-cards-should-i-have

- https://www.nerdwallet.com/article/small-business/how-many-business-credit-cards-should-i-have

- https://www.bill.com/blog/how-many-business-credit-cards

- https://www.agencyauto.net/blog/travel-tech/top-travel-agent-tools-complete-software-guide/

- https://www.paisabazaar.com/credit-card/best-business-credit-card-in-india/

- https://www.brex.com/spend-trends/corporate-credit-cards/easiest-business-credit-cards-to-get

- https://www.bankbazaar.com/credit-card/corporate-credit-card.html

- https://www.cardexpert.in/best-credit-cards-india/

- https://www.volopay.com/in/blog/best-corporate-credit-cards-india/

- https://www.hdfcbank.com/personal/pay/cards/business-credit-cards

- https://select.finology.in/credit-card

- https://www.zeni.ai/blog/best-corporate-credit-cards

- https://omnicard.in/blogs/best-corporate-cards-in-india-030325

Leave a Reply