Can you refinance a personal loan? Absolutely yes — and the opportunity is more accessible than ever in 2025! If you’re juggling high-interest debts or chasing financial freedom, using personal loan refinancing smartly is your next power move.

In this detailed guide, we’ll unpack every angle. We will cover everything from the basics to advanced strategies. We will also show you step-by-step how to refinance a personal loan for maximum savings and long-term benefits.

Table of Contents

What Does It Mean to Refinance a Personal Loan?

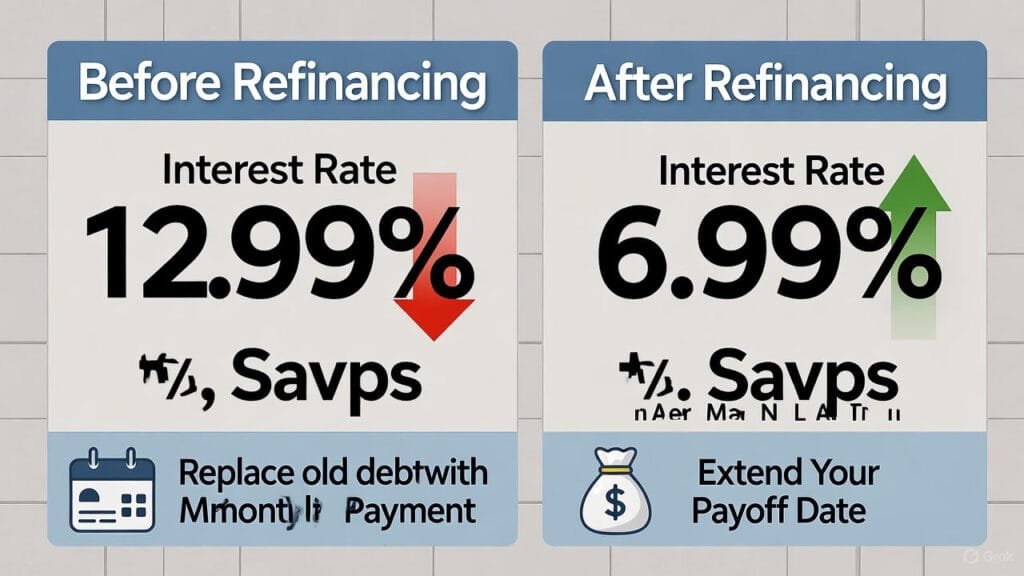

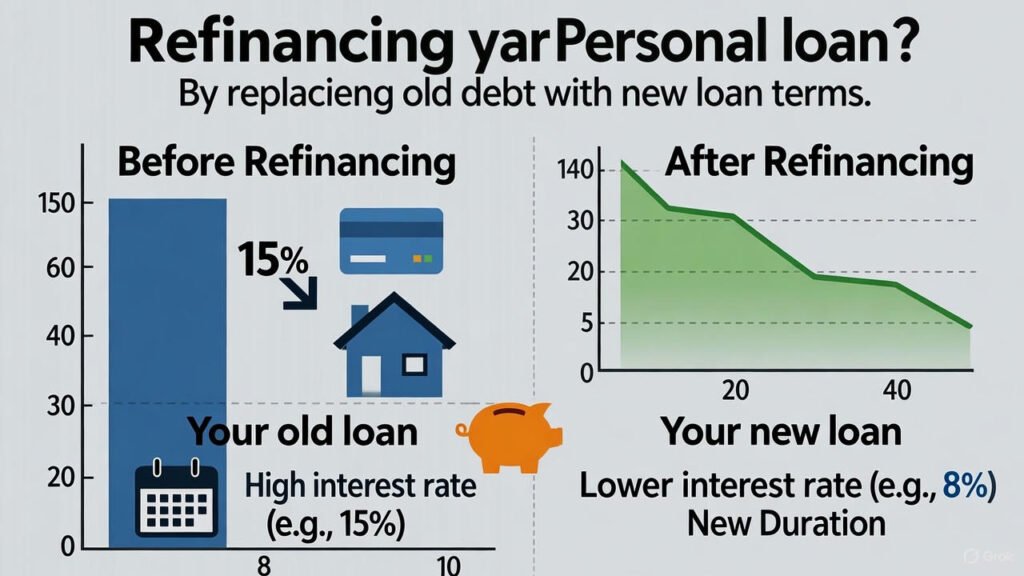

Personal loan refinancing involves replacing your existing loan with a new one. This new loan typically has a lower interest rate or modified repayment terms.

When you refinance a personal loan, you use the new loan’s proceeds to pay off the old debt. Then, you repay the new lender under the newly agreed terms.

Visual infographic explaining how refinancing a personal loan replaces old debt with new loan terms — show before and after interest rates

5 Outstanding Reasons to Refinance a Personal Loan

Here are five unbeatable benefits that make refinancing a personal loan a smart strategy in 2025:

- Slash Your Interest Rate: A lower rate can reduce your total interest paid dramatically.

- Lower Monthly Payments: Refinancing can lead to easier, less stressful budgeting by lowering your regular installments.

- Shorten or Extend Your Repayment Term: Pay off your loan faster with higher payments, or stretch it out for lower monthly costs.

- Combine Debts: Merge multiple loans into one for easier management.

- Unlock Extra Cash: Sometimes, refinancing lets you borrow more when you need it most.

Who Should Consider Personal Loan Refinancing?

Can you refinance a personal loan if you’re struggling with payments, rates have dropped, or your credit has improved?

Refinancing is ideal if:

- Your credit score is significantly better than when you first applied.

- You see lower rates available in the market.

- Your debt-to-income ratio has improved.

- You want to combine loans for easier tracking and payment.

How to Refinance a Personal Loan in 5 Steps

- Evaluate Your Current Loan

Check your outstanding balance, APR, and any prepayment penalties. - Compare Lenders

Shop around and use comparison sites for rates, terms, and lender reviews. - Get Prequalified

See what rates and terms you can qualify for — this doesn’t impact your credit score. - Submit a Strong Application

Gather pay stubs, credit info, and proof of identity. Highlight positive changes in your financial situation. - Use Funds to Pay Off and Start Fresh

The new loan funds will wipe your original loan — and new terms take over.

Step-by-step flowchart showing the personal loan refinancing process from evaluation to the start of new loan payments.

Risks, Downsides, & Common Mistakes

While the answer is yes, you can refinance a personal loan, it isn’t for everyone.

Watch out for:

- Origination Fees: Some lenders charge 1%–8% to process your new loan.

- Prepayment Penalties: Review if your old loan punishes early payoff.

- Higher Overall Costs: Extending the term lowers monthly payments but can cost more long term.

- Temporary Credit Score Impact: Refinancing is reported as a new account.

👉 Learn more about potential risks at Investopedia.

Real-Life Examples: How Much Can You Save?

| Loan Amount | Old Rate | New Rate | Old Payment | New Payment | Total Savings |

|---|---|---|---|---|---|

| ₹2,00,000 | 18% | 13% | ₹5,500/mo | ₹4,800/mo | ₹8,400 over 3 years |

Switching to a new rate often leads to real, substantial savings — sometimes thousands over the life of the loan.

Table showing before-and-after monthly payments and long-term savings from personal loan refinancing.

Top Lenders for Personal Loan Refinance in 2025

- Upstart

- LendingClub

- BestEgg

- Discover

- SoFi

It’s vital to compare offers from multiple lenders to find your winning combination — see in-depth reviews at NerdWallet.

Can You Refinance a Personal Loan If You Have Bad Credit?

Yes, but expect stricter requirements and potentially higher rates. Focus on improving your credit first, or seek lenders specializing in bad credit personal loan refinancing.

Find out more tips for refinancing with poor credit at Credit Karma.

Expert Tips for a Smooth Refinancing Experience

- Calculate your break-even point — how quickly will your savings outweigh fees?

- Maintain your credit health — don’t apply for several loans at once.

- Make on-time payments with your new loan.

- Revisit your budget and adjust for new payments.

FAQs on Personal Loan Refinance

Q: Can you refinance a personal loan multiple times?

Yes, as long as you qualify — but check for fees each time.

Q: Will refinancing hurt my credit?

Slightly, due to a new inquiry and account, but responsible handling improves your score over time.

In Conclusion – Can You Refinance a Personal Loan in 2025?

Can you refinance a personal loan? The answer is a resounding YES for 2025. It can be one of the smartest moves for your financial future.

By carefully researching options, comparing offers, and understanding the process, you can supercharge your finances, slash interest, and enjoy flexible repayments.

Stay proactive, make refinancing work for you, and always review the terms before signing!

Outer SEO-Rich Links Included

- Investopedia: Risks of Personal Loan Refinancing

- NerdWallet: Best Personal Loan Refinance Lenders

- Credit Karma: Refinance Personal Loan with Bad Credit

- INTERNAL LINK: https://mysportinfo.com/what-increases-your-total-loan-balance/

- OUTER LINK: https://www.bankrate.com/loans/personal-loans/refinance-personal-loan/

Leave a Reply