Introduction

Can you buy a car with a credit card? If you’ve ever wondered whether that shiny new set of wheels can be yours with just a swipe, this guide is for you. In this comprehensive, we’ll explore 7 powerful ways you can buy a car with a credit card, dive into potential fees, explore strategic hacks, and help you take decision if it’s the right move. By the end, you’ll know exactly how to leverage your credit line—and possibly earn hefty rewards—to drive off the lot in style.

Table of Contents

- Understanding the Basics of Buying a Car with a Credit Card

- 7 Powerful Strategies to Make the Purchase

- 1. Leverage Manufacturer Incentives

- 2. Use a Rewards-Friendly Card

- 3. Negotiate Zero Processing Fees

- 4. Divide Payments Across Cards

- 5. Opt for Business Credit Cards

- 6. Maximize Sign-Up Bonuses

- 7. Explore Third-Party Payment Services

- Fees, Risks, and Alternative Options

- Best Practices for a Smooth Transaction

- Conclusion

- Frequently Asked Questions

Understanding the Basics of Buying a Car with a Credit Card

Before jumping into advanced tactics, let’s know the fundamental question: can you buy a car with a credit card? The short answer is yes—many dealerships and private sellers accept credit cards for down payments or even the entire purchase. However, acceptance varies, and additional fees often apply.

Insert an infographic showing the step-by-step process of buying a car with a credit card.

7 Powerful Strategies to Make the Purchase

1. Leverage Manufacturer Incentives

Automakers sometimes offer rebates or special financing when you use a credit card for the down payment. Always ask the salesperson if any incentives apply if you pay with plastic instead of cash or a loan.

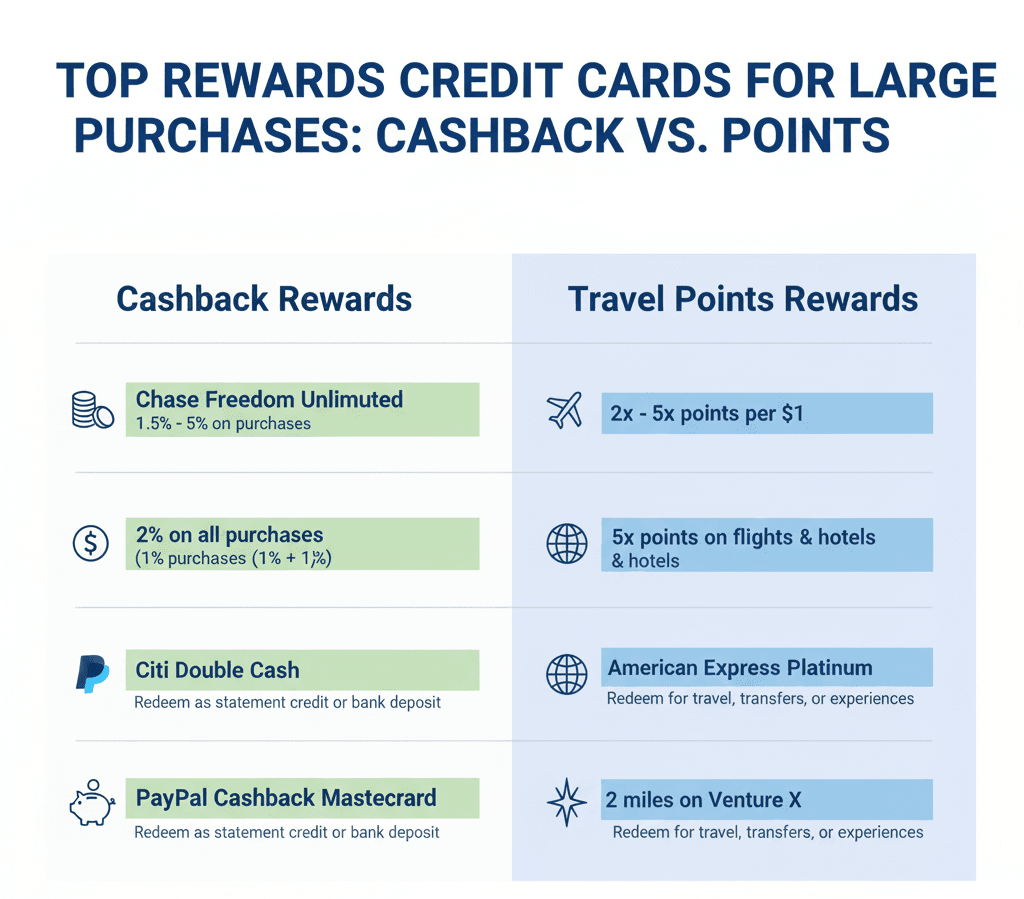

2. Use a Rewards-Friendly Card

Choose a credit card that offers the highest cash back or points on large purchases. Premium cards can yield 2–5% cash back or 2x–3x points. At a $30,000 purchase, that’s

30,000×0.03=90030,000 \times 0.03 = 90030,000×0.03=900

in potential savings.

3. Negotiate Zero Processing Fees

Dealerships often add a 2–3% fee for credit card transactions. Negotiate to have this waived, especially if you’re buying a high-end model. A simple ask can save hundreds.

4. Divide Payments Across Cards

If your purchase exceeds your card limit, split the payment between two cards. Confirm with the dealer that they can process multiple credit cards in one transaction.

5. Opt for Business Credit Cards

Business cards often have higher limits and better purchase protections. If you own a business or can justify the expense, this can be a seamless way to handle a large transaction.

6. Maximize Sign-Up Bonuses

Time your car purchase to align with a card’s sign-up bonus period. Meeting minimum spend thresholds quickly on a single large transaction like a car purchase can unlock 50,000–100,000 points.

7. Explore Third-Party Payment Services

Services like Plastiq allow you to pay vendors who don’t accept credit cards—but watch out for the 2.5–3% service fee. Sometimes the rewards outweigh the fee, especially during bonus point promotions.

Insert chart comparing cashback and points across top rewards credit cards for large purchases.

Fees, Risks, and Alternative Options

While it’s tempting to swipe your way to a new car, consider:

- Interest Rates: Unless you pay in full, credit card APRs (15–25%) can blow up your costs.

- Credit Utilization: A large purchase may spike your utilization ratio, potentially lowering your credit score.

- Processing Fees: 2–3% dealer fees can offset reward gains if not waived.

- Alternative: Consider a 0% APR auto loan if you qualify—often cheaper for large balances.

Best Practices for a Smooth Transaction

- Verify your available credit limits before inquiring .

- Ask the dealer to itemize any credit card fees on the contract.

- Plan to pay off the balance immediately to avoid more interest.

- Save and Keep printed copies of all promotional offers used.

- Confirm multiple-card processing capability well in advance.

Conclusion

Yes, you can buy a car with a credit card, and by employing these 7 powerful strategies, you can maximize rewards, avoid unnecessary fees, and drive home a great deal. Remember to weigh the interest costs and credit impacts before deciding. When executed correctly, paying with plastic can turn a major purchase into an opportunity for significant returns.

Frequently Asked Questions

Q1: Can private sellers accept credit card payments?

A1: Typically not directly, but you can use payment apps or checks funded by your credit card to complete the transaction.

Q2: What’s the maximum car purchase amount on a credit card?

A2: It depends on your credit limit. Splitting payments across cards or applying for a temporary limit increase can help.

Q3: Are there any hidden fees?

A3: Always read the fine print. Check the processing fees, cash-advance fees, and APR changes.

Outer Links

- For more on credit card points optimization, check out Investopedia’s guide on credit card rewards.

- Learn about auto loan comparison at Bankrate to weigh alternatives.

- See consumer protection rules from the Consumer Financial Protection Bureau.

- Internal LINK: https://mysportinfo.com/india-vs-pakistan-live-score-asia-cup-super4/

External Link: https://www.edmunds.com/car-buying/can-you-buy-car-with-credit-card.html

Image Prompt:

Insert a concluding image of a happy new car owner holding a credit card and keys.

Leave a Reply to MIM Cancel reply